Categories

Latest Posts

Skai Director of Sales joins Podean as Director of Retail Media Partnerships

September 12, 2023

Podean Turkey launches & unveils ecommerce research

August 5, 2022

18TH March, 2020

Navigating through uncertain waters

In this post we discuss some of the key observations, implications and opportunities for brands to leverage Amazon and e-commerce during the current global Covid-19 crisis.

We are happy to provide no-charge advice to brands around the world. Please get in contact with us via www.podean.com/contact

Macro trends

Economic stimulus.

US Government likely to send $1000 checks to middle/lower-income citizens.

Podean perspective:

In past recessions and downturns we encountered the “lipstick effect” where people would still buy cosmetics as an affordable luxury that made them feel better in tough times, and instead of buying expensive items such as a designer handbag.

When government has sent checks in the past, often this was invested in household items (especially plasma TVs in the GFC) and entertainment as people used the money to upgrade their home and for escapism.

We believe any such monetary stimulus for Covid-19 will be used for essentials such as groceries and utilities as many people are without jobs (especially those in the services trades) and have no idea when they’ll even be able to leave their home.

Implication for brands:

Focus efforts on lower priced items where possible. Give your marketing a feel of luxury.

Shifting shopping behavior.

Podean perspective:

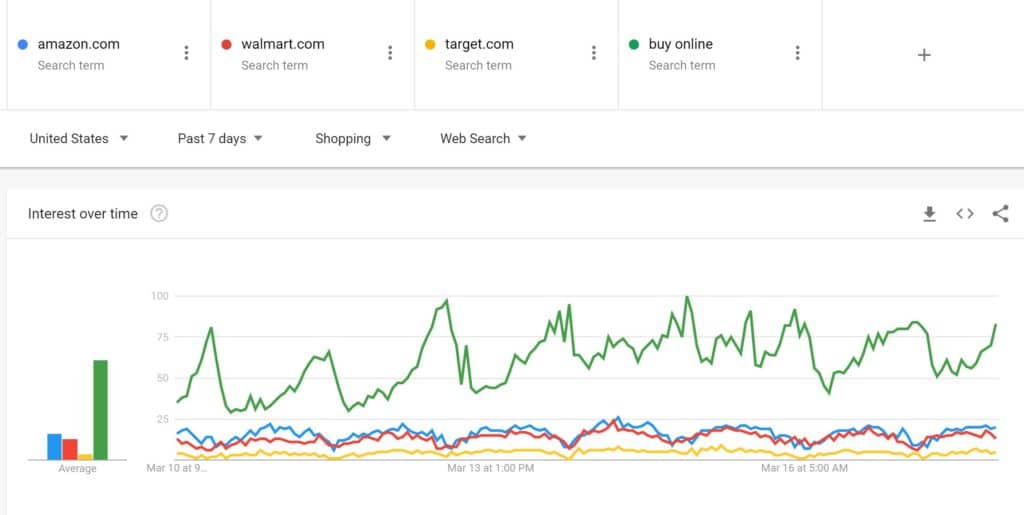

With daily updates on the virus, people are quickly moving the bulk of their shopping online. Google trends data for the US last 7 days reinforces this assertion – searches for the term “Buy Online” increased 51% (ix43 to ix65 – using trendline), Amazon.com searches increased by 33% (from ix15 to ix20), Walmart.com searches increased 66% from a slightly lower base (ix9 to ix15) and Target.com increased 150% from a very small base (from ix2 to ix5).

Amazon Logistics

Delivery Delays

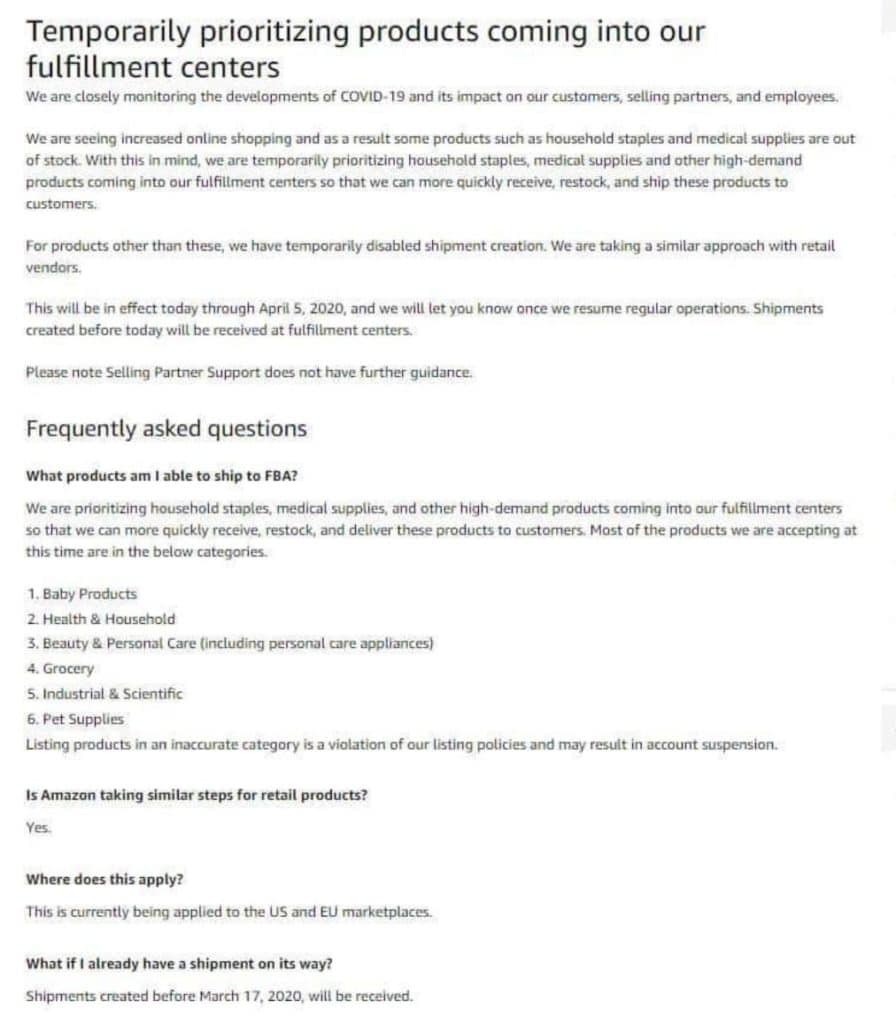

Amazon has sent a notice to suppliers warning of receiving delays due to prioritizing certain products, “With this in mind, we are temporarily prioritizing household staples, medical supplies, and other high-demand products coming into our fulfillment centers so that we can more quickly receive, restock, and deliver these products to customers.”

Podean perspective:

With Amazon needing to employ 100,000 people to keep up with demand we understand there are some delays however feel their infrastructure will return to normal within two weeks – there is simply too much consumer demand across all categories for them to risk out of stock, and lost margin (especially when their bricks and mortar competitors are largely being shut, or vacant).

Note that a more detailed notice was posted (see below) that mentioned baby, grocery, beauty, pet and household products would be exempt.

We also feel this message is timely for PR purposes to ensure the general public – and government – don’t see Amazon as profiteering in a crisis.

Implication for brands:

Keep an eye on such notices and if you have the opportunity to move product into FBA, take advantage.

Demand Forecasting Challenges.

With daily economic, societal fluctuations demand is hard to predict.

Deliveries may also slow (Amazon has flagged this), leading to drops in consumer sentiment.

Podean perspective:

Brands should not just use FBA for their most critical and high-volume / high-margin products. They should have stock in other warehouses and infrastructure available to manage their own deliveries (USPS/UPS/Fedex).

Implication for brands:

Don’t forget logistics optimization. Running out of stock could be detrimental and there are many 3PL companies we partner with for clients.

Media

Overall changes in consumption

Podean perspective:

Where more and more Americans are confined to their homes, media consumption will increase. Amazon is uniquely positioned to reach consumers across their assets – Amazon Music, Amazon Video, IMDB TV and through their devices including Fire Tablets, Apps in FireTV and through Amazon Alexa skills. A key benefit of using Amazon as a partner (versus say Hulu or Spotify) for this is not just reach and cost-effectiveness, but also attribution from exposure through to adding to cart and ultimately sale.

Implication for brands:

With marketing budgets being tightened, attribution and effectiveness are critical, and Amazon is perfectly poised to deliver such metrics and accountability.

Brands should carefully plan their reach and frequency thresholds to ensure they are not over-saturating their audiences, and turning them off

Search / Sponsored Ads / Sponsored Brands

Podean perspective:

In categories that are being prioritized by Amazon, and where consumer demand is increasing (household staples especially), search competition will increase. Podean’s own clients are significantly up-weighting their advertising spend by 100%+ during the next month, and seeing sales of some products increase 600%. This competition will lead to higher CPCs through the auction mechanism, and may slightly impact ROAS but should be offset by increased sales volumes and organic sales.

Implication for brands:

Re-think your search strategy, bids, competitive set, share of voice and technologies used to assist campaign optimization

Display Advertising

Podean perspective:

Many large brands that are not selling household essentials are putting their advertising spend on hold. That includes airlines, travel, services (dentists, doctors, cleaners), restaurants and entertainment among others. This will decrease overall demand for DSP advertising and make it more cost-effective; whether display or video/OTT.

Implication for brands:

Brands should be heavily investing in display retargeting on search, and in dynamic display ads that can feature star rating, reviews, buy now, subscribe and save. This unusual time can help build brand saliency when you have a greater share of mind.

Competitive share

Changes in purchasing behavior

Podean perspective:

With belts tightening and uncertainty around employment, income and health when people do choose products they will look for value over brand and frills. We believe there is an opportunity for value-based brands to conquest premium brands they may not have in the past. This can also be reflected in your display/video advertising where you can include “value for great quality” messaging.

Brands should urgently update ad creative, copy and content (eg. comparison tables) to address a premium audience you may not have previously targeted. This can include A/B testing of A+ content.

About Podean

Latest Posts

Skai Director of Sales joins Podean as Director of Retail Media Partnerships

September 12, 2023

Comments are closed.