Spoiler alert – The new inbound and FBA fees aren’t going to impact your profit nearly as much as poor inventory management and high returns will.

Amazon’s announcement in December 2023 of the new Fulfilled by Amazon (FBA) fees that now include inbound charges has caused a massive stir in the seller community. The reddit forum has thousands of comments and the topic has lit up LinkedIn by big brands, small brands, agencies and partners.

As is typical for Amazon, these updates include some additions, some changes, some subtractions and it’s all a bit confusing – likely designed that way to subvert attention (“hey, look over here!”).

The Podean team crunched the numbers to see what it really means for brands and their partners, and what they should do to address these changes.

Firstly, we need to understand what the “old” FBA fees really were, not just what is shown on the ratecard. We need to account for seasonality, as there was a higher FBA fee (peak) for Q4 when many brands sell a larger portion of their annual sales.

Having done this, we compared those fees versus three scenarios: the maximum inbound fee (shipping to a single Amazon FC), the minimum inbound fee (more than one FC), and no inbound fee (client shipping to multiple Amazon FCs). We also accounted for the newer tiers where costs varied by the quarter pound, rather than half pound increments in the past.

Here are the conclusions we came to across the 28 different sizes analyzed (small standard and large standard sizes) ranging from less than 2oz all the way up to 19lb package:

- Where a brand sells equal units every month, and are now paying the maximum inbound fee, the aggregate fee rises 3.24% (ranging from 1.2% to 9.1%) and of the 28 sizes, 27 are higher and only one is lower

- Where a brand sells 40% of annual units in Q4, and are now paying the maximum inbound fee, the aggregate fee rises 2.02% and 23 are higher with 5 lower

- Where a brand sells equal units every month, and are now paying the minimum inbound fee, the aggregate fee rises 0.42% and of the 28 sizes, 13 are higher and 15 lower

- Where a brand sells 40% of annual units in Q4, and are now paying the minimum inbound fee, the aggregate fee DECLINES 0.76% and 10 are higher with 18 lower

- Where a brand sells equal units every month, and are now paying NO inbound fee, the aggregate fee DECLINES 5% and of the 28 sizes, 2 are higher and 26 lower

- Where a brand sells 40% of annual units in Q4, and are now paying NO fee, the aggregate fee DECLINES 6.12% and 1 is higher with 27 lower

But does any of this make a substantial difference?

Let’s say your product sells for $20, and the FBA fee was $5.00 and is now +3%; your FBA fee as a percentage of sales price has risen from 25% to 25.75%. If your product sold for $100 and FBA was $8 (8%), it’s now 8.24% – not much of a difference, really.

What about timing and the fact that the new inbound fee is underway but the lower FBA fees start April 15th?

Well, for most brands, the items sold between Feb 5-April 14th (roughly six weeks), will be sold at the non-discounted FBA fee but it was also received by Amazon weeks/months ago with no inbound fee. From Feb 5-April 14, brands are paying for inbound but unless the same stock is sold in that six week period, they’re not incurring the regular FBA fee – they’ll be paying the lower one.

The brands that hurt the most during this period are those launching with new stock that incurs the inbound fee and the higher FBA fee.

A more pressing challenge – Inventory Levels

Is your inventory aged? Here’s a fee. Is your inventory low? Here’s another fee.

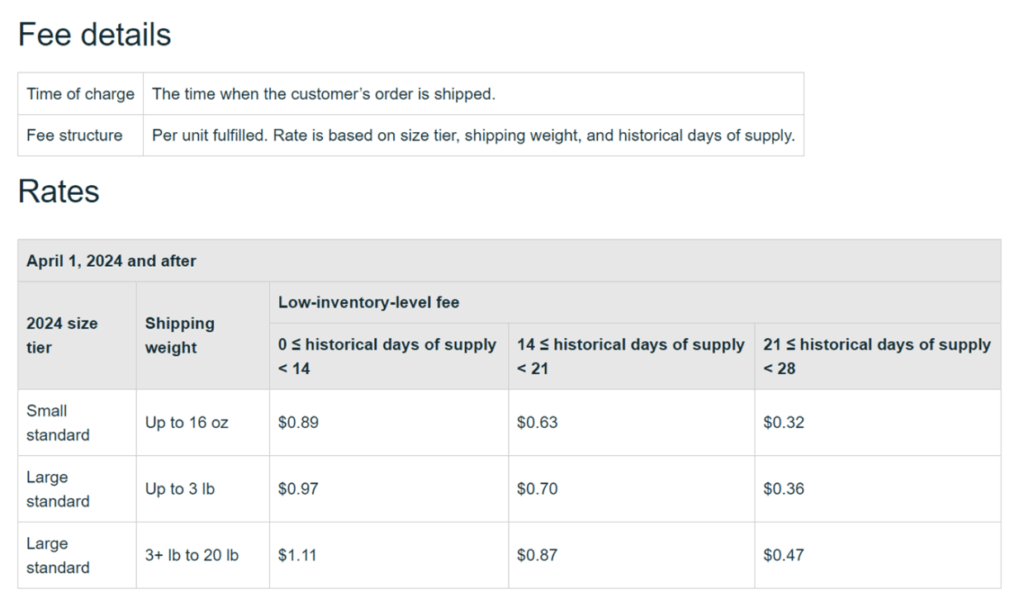

On top of the new FBA and Inbound fees, a completely new fee will threaten brands not managing their inventory closely. It’s called the low-inventory-level fee, and it will be applied on top of the FBA fee for every unit sold anytime your inventory level is below the 28 days of supply threshold.

- The fee will be applied only to small standard and large standard sizes

- There are 3 low-inventory thresholds – lower days of supply mean higher fee

Amazon will calculate the historical days of supply for the last 30 and 90 days, and use the higher one to determine if your product falls below the threshold.

- Amazon will only account for the sellable inventory you have at their warehouses (sellable, in-transfer, reserved) when calculating the days of supply, and it will exclude whatever inventory you have inbound.

- Days of supply will be calculated at the parent level (that’s a good thing in cases where one or two variations are selling a lot and constantly running low on stock – the other low-selling variations will offset the calculation by adding their “high” inventory to the mix)

Being on top of your inventory levels will be critical, as fees can increase exponentially if you’re not closely monitoring demand shifts. Products with lower price points will be the most affected by this addition. Depending on how long you’re running on low inventory relative to the product price, margins can diminish significantly.

If you’re incurring low-level-inventory fees, our analysis has shown that this can impact your overall margin by 1% to over 2.4% depending on retail pricing, sizing, and inventory level data. Where the inbound+new FBA fee could impact your bottom-line 0.2-0.75%, if (in our modeling) you sell 40% of your inventory with 28 or fewer days of stock on hand, you will incur 3x to 7x greater loss of profit.

High Returns Hurt

Another challenge brands are not talking about is the returns processing fees.

Returns processing fees have been long-incurred by Apparel, but from June 1st, 2024, such fees will apply to products with high returns. (Note that “high” has yet to be defined and may vary by category, but is suggested to be above 20%). These fees are considerable, ranging from $1.78 per unit (for the smallest size) to $5.00 for standard sizes. This is on top of your FBA+inbound+low-inventory+warehouse+other fees.

To maintain profit you, again, need to ensure products have low return rates. You can do this by reading and actioning reviews, addressing concerns in your content, being on top of Q&A, providing sizing charts, and many more avenues. If you have products with high returns (potentially faulty or have ongoing issues), consider removing them for sale or switching from FBA to FBM. The impact could be an increase in your seller fees of 20-50% and impact on revenues of 1-3%.

This is what brands should focus on.

In summary, what should brands do?

- Worry most about your inventory levels – those fees are less talked about but are the ones that will hurt your margin the most if you don’t get the balance right.

- Where it’s operationally feasible (say you’re a huge brand with multiple warehouses across the country), ship to more warehouses to save inbound fees.

- If you cannot, don’t stress – the actual incremental cost is minimal under the new structure. The operational lift and additional shipping costs may outweigh the small revenue loss.

- Avoid launching new brands right now if you can – the combination of inbound fees and the higher FBA fees is a double whammy if you sell that stock before April 15th.

- Understand that cashflow is changing. In the past, you paid the entire FBA fee when the item was sold. Now you’ll pay inbound sooner, and well before the item sells. Again, having stock sit too long will mean you’re waiting a long time before offsetting these many fees with your sale proceeds.

All roads point to retail operations and logistics skills being at the forefront.

If you and your partners are not experts in forecasting, shipping plans, and inventory management, you’ll suffer sorely. Also bear in mind there’s now more work for internal teams and partners, so you’ll need to ensure they’re resourced appropriately.

Having a trusted agency partner can be make or break in moments like this, and Podean’s highly-trained retail team can help you navigate and strategize around these changes – contact us today to schedule time with our team.

Comments are closed.